What a user and data problem has to do with a 20% decline in lending to SMEs in the UK.

The August '24 global stock meltdown was partially attributed to unjustified AI spending. However, this shouldn't distract us from the fact that there are still big issues with business as usual, which AI and related technologies can help solve.

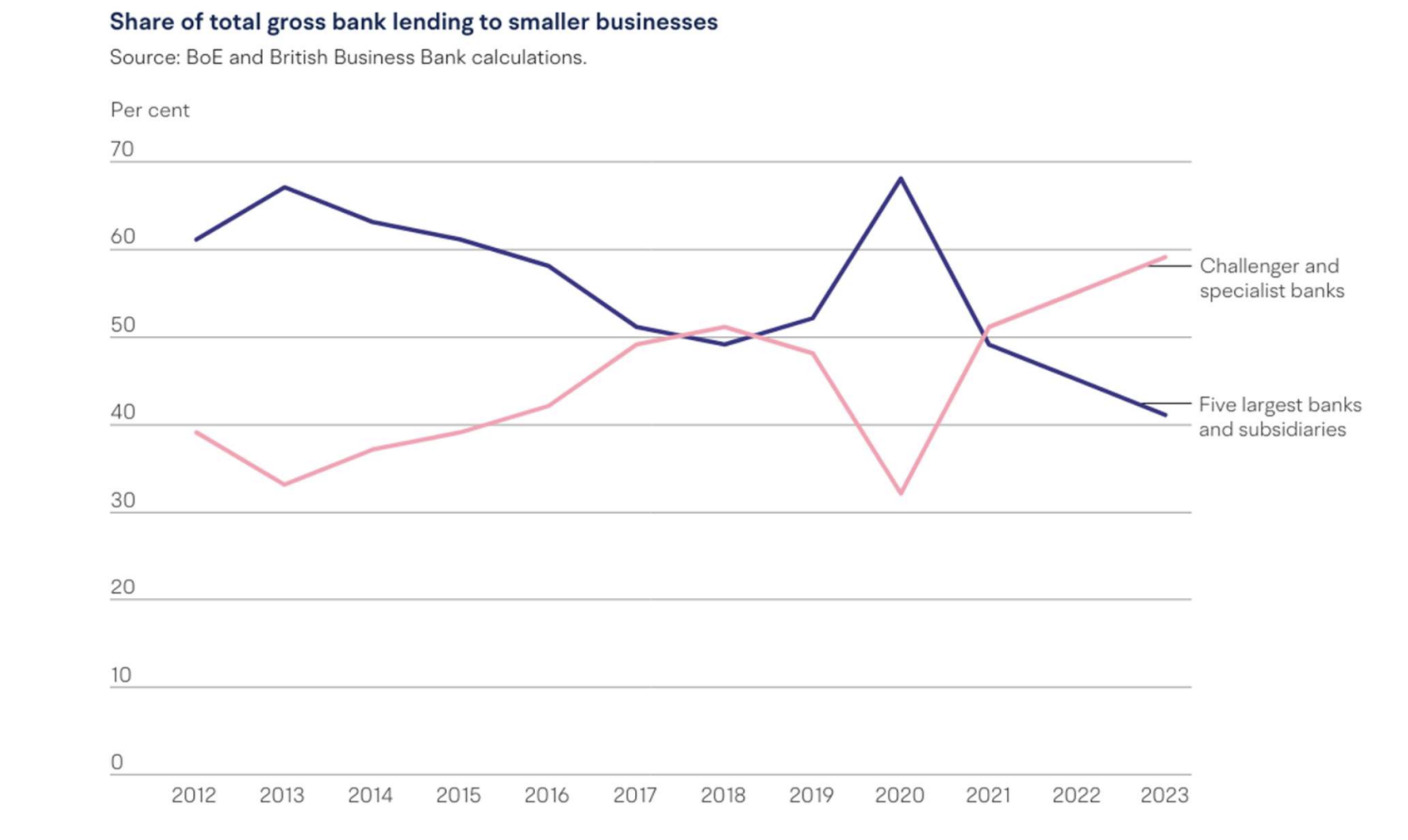

A newly published report by a UK´s SME Finance Taskforce highlighted how over the past decde, lending to SMEs has declined by 20% in real terms. This equals a estimated funding gap of £22billion. "Some of that (problem) is because the data being held around these companies has become extremely complex" for financial institutions to confidently evaluate lending opportunities and promptly establish companies´ eligibility - explains Charlotte Crosswell, chair of the task force, speaking at BBCRadio4 Today´s programme, on August 1st.

And as a result, sometimes lending is not offered to those companies who desperately need it. Also companies often give up on expanding their business, hiring the next person or acting upon opportunities for modernising and innovating their operations. These are the kind of business problems that we should talk about when we talk about AI.

Data accessibility, prompt information retrieval, manual processes that slow businesses down. If anything, the UK case proves how huge are social and financial costs of business as asual. It reminds us how pertinent are the notions of AI, trusted data and information access and findability - regardless how abruptly the narrative surrounding AI can change on Wall Street.

Misplaced Skepticism?

Rather regrettably, the SME´s taskforce announcement came only a day before a huge sell-off of tech stocks -subsequent market meltdown , which sparked some comparisons with the Dot.com bubble of the 2000.

In the ensuing mayhem, fears of an AI overvaluation were blamed, along with those of a slow down of US Economy. While it can be difficult to discern the real reasons of such powerful market freak-outs, one thing is sure and it´s that investment on AI by big tech has been interpreted very differently and on a case-by-case basis.

AI´s impact on financials

In the case of Meta, for instance, investors were quicker to forgive the company´s raise in capital expenditures to support its AI infrastructure, as revenue and earnings exceeded analysts' expectations. Meta put the strong quarter down to artificial intelligence (AI) developments, with its new model Llama 3.1.

Elsewhere businesses seem to see value from AI adoption and new estimates have been published on the impact of AI on operating profits across sectors. But the financial market slump inevetably spurred a spate of headlines, as if AI was getting, words from Fortune, "a well-deserved reality check", at least spending-wise and particularly in the field of Gen AI.

However, disparaging AI risks underestimating its already significant impact on our daily lives, and its potential to address challenges as complex and important as the lending issues for UK SMEs. What seems fair to point out though, is the discrepancy between the 1 trillion investments in Gen AI (estimate) and the lack of pay-off so far. So, if we´re at a turning point in AI´s trajectory, there may be a few facts that are important to pick up from a business strategy perspective.

- Different AI technologies (Generative, predictive, machine learning) bring value depending on the different use case. Thus, finding out the most valuable use cases has to become a core element of any AI strategy

- Small incremental improvements to AI applications could bring enormous value to users and businesses, and that´s a different strategy than chasing massive breakthroughs, which has been the main focus until now.

- The opportunity is there to embrace small language models - (SMLs) to drive performances at significantly lower costs

A key lesson to keep in mind from the recent financial market scare is that economic reality and market reality are two very different things. The volatility that´ve seen is not because of dramatic changes in the global economy, but rather of speculative manouvres - like the abundance of leveraged ETFs which magnified losses on AI stocks and contributed to exacerbate volatility. The underperformance of these securities cannot be taken alone as an indicator of the value of AI investments.